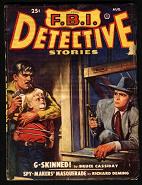

THE RISE OF MORTGAGE FRAUD And How It Impacts You - FBI 12/14/05

Believe it or not, this Detroit home sold for $25,000 one day...and $250,000 the next. An extreme makeover? No, an egregious case of mortgage fraud, where the property was illegally "flipped"—bought, falsely appraised at a much higher price, and quickly resold—by a crooked appraiser who's now in jail.

Believe it or not, this Detroit home sold for $25,000 one day...and $250,000 the next. An extreme makeover? No, an egregious case of mortgage fraud, where the property was illegally "flipped"—bought, falsely appraised at a much higher price, and quickly resold—by a crooked appraiser who's now in jail.

Why should you care?

Because these scams not only hurt lending institutions and real estate professionals—and ultimately the health of the U.S. economy—they con significant numbers of homeowners in the U.S. every year. If you're buying property, refinancing a mortgage, or looking for creative ways to eliminate home loans and other debts, you could be a target, too.

For example (and we've seen all this and more in recent cases):

You could be offered what seems like an attractive deal—buy a rental property with no money down and get cash kickbacks after the loan closes—but later learn the properties are worthless and get stuck with loans you can't afford to pay. You could get an e-mail promising to eliminate your mortgage loans or credit card debt for an up-front fee, only to pay the money and get nothing in return. If you're having trouble paying your mortgage, you could be approached by scam artists who promise to save your home if you transfer the deed to them and/or pay thousands for a new loan, but they either pocket the fees or remortgage the property and keep the proceeds.

You could unknowingly buy a home that's been flipped several times recently, artificially inflating its value. You could provide personal information in response to a "Help Wanted" ad, only to have your identity stolen and used to apply for mortgage loans in your name.

To help educate you on these scams and to outline the steps we're taking to address what has become one of the fastest growing white collar crimes in the nation, the FBI on 12/14 joined with the Department of Housing and Urban Development, the U.S. Postal Inspection Service, the Internal Revenue Service, and the Department of Justice in announcing "Operation Quick Flip."

Together, as part of this effort, we're providing the following resources:

A list of mortgage fraud prevention tips, including specifics on mortgage debt elimination schemes, foreclosure fraud, and predatory lending scams.

A complete description of the many kinds of mortgage fraud, from backward applications to silent seconds, as well as a rundown on what we're doing to combat the problem with statistics and major case summaries.

Additional information, including flow charts on how scams like property flipping, air loans, and double sold loans can work and maps showing the top ten "Hot Spots" for mortgage fraud in 2003 and 2004.

Also see some pictures from recent mortgage fraud cases around the country.

Our top Criminal Investigative Exec Chris Swecker said that many of the cases involve insiders.

“It’s either a corrupt appraiser, a corrupt mortgage broker, a corrupt lawyer, a corrupt banker—somebody inside the system has gone bad and is exploiting vulnerabilities in the mortgage application process,” he said.

He warned consumers to be alert and to be wary of so-called sure-fire investments.

Resources:

National Press Release - Recent California Foreclosure Scam Case

Recent opinions of the U.S. Court of Appeals regarding the fee-splitting prohibitions of the Real Estate Settlement Procedures Act have buoyed Department of Housing and Urban Development lawyers who maintain the cases have confirmed their long-held position that markups of appraisals and other settlement services provided by third-party vendors violate RESPA.

Of the six U.S. appeals courts that have ruled on markups, the results have been split. The first three opinions went against HUD's position, with rulings that the statute prohibits fee-splitting between two parties, not markups by a single party. However, the three latest decisions have ruled against such markups. See my earlier series "Kickback or Markup"

In remarks before attendees of a RESPA conference sponsored by the National Real Estate Development Center, HUD assistant general counsel Peter Race said, "The decisions in the recent cases have undercut the rationale in the earlier cases. It is hard to argue that the statutory language is clear on its face when three other circuit courts and HUD (the agency charged with enforcement of the statute) are taking a different position," he said.

The Appraisal Institute has had a long-standing opposition to the mark-ups. Don Kelly, vice president of Public Affairs said, "Lenders jacking up appraisal fees while providing no additional service to borrowers is outrageous. We've fought against this practice for years now and it's good to see the courts are agreeing with us."

In the past 18 months, HUD has been very aggressive in investigating and pursuing cases involving referral fees and sham affiliations. Of the 45 settlements in the history of RESPA, the department settled 14 cases last year. Race said, "HUD will continue to closely look at markups of third-party charges. And we will take action when there is no work done or little work done to justify a markup of charges."

Source: Appraisal Institute News

Recent opinions of the U.S. Court of Appeals regarding the fee-splitting prohibitions of the Real Estate Settlement Procedures Act have buoyed Department of Housing and Urban Development lawyers who maintain the cases have confirmed their long-held position that markups of appraisals and other settlement services provided by third-party vendors violate RESPA.

Of the six U.S. appeals courts that have ruled on markups, the results have been split. The first three opinions went against HUD's position, with rulings that the statute prohibits fee-splitting between two parties, not markups by a single party. However, the three latest decisions have ruled against such markups. See my earlier series "Kickback or Markup"

In remarks before attendees of a RESPA conference sponsored by the National Real Estate Development Center, HUD assistant general counsel Peter Race said, "The decisions in the recent cases have undercut the rationale in the earlier cases. It is hard to argue that the statutory language is clear on its face when three other circuit courts and HUD (the agency charged with enforcement of the statute) are taking a different position," he said.

The Appraisal Institute has had a long-standing opposition to the mark-ups. Don Kelly, vice president of Public Affairs said, "Lenders jacking up appraisal fees while providing no additional service to borrowers is outrageous. We've fought against this practice for years now and it's good to see the courts are agreeing with us."

In the past 18 months, HUD has been very aggressive in investigating and pursuing cases involving referral fees and sham affiliations. Of the 45 settlements in the history of RESPA, the department settled 14 cases last year. Race said, "HUD will continue to closely look at markups of third-party charges. And we will take action when there is no work done or little work done to justify a markup of charges."

Source: Appraisal Institute News